What Insurance Covers IVF: Your Guide to Fertility Treatment Coverage

Navigating the world of insurance can feel like trying to solve a puzzle with missing pieces—especially when it comes to something as personal and life-changing as in vitro fertilization (IVF). If you’re wondering what insurance covers IVF, you’re not alone. Millions of people across the U.S. face infertility challenges, and the cost of treatments like IVF can be overwhelming without financial help. The good news? Some insurance plans do offer coverage, but the details vary widely. This guide will walk you through everything you need to know— from how coverage works, to what you can expect to pay, to practical steps for finding a plan that fits your needs.

Let’s dive into the world of IVF insurance coverage and uncover the options, surprises, and strategies that can make your journey to parenthood a little less stressful.

Understanding IVF and Why Insurance Matters

IVF is a medical procedure where eggs are retrieved from the ovaries, fertilized with sperm in a lab, and then transferred into the uterus. It’s a powerful tool for building families, especially for those facing infertility, same-sex couples, or single individuals using donor eggs or sperm. But here’s the catch: one round of IVF can cost anywhere from $12,000 to $20,000—or more if you need multiple cycles. Add in medications, lab fees, and extras like genetic testing, and the bill can climb even higher.

For most people, that’s not pocket change. Insurance can be a game-changer, turning an out-of-reach dream into a real possibility. Yet, unlike routine doctor visits or emergency care, IVF isn’t always seen as “medically necessary” by insurers. This leaves many wondering: Will my plan cover it? The answer depends on where you live, who you work for, and what kind of policy you have. Let’s break it down.

Does Insurance Typically Cover IVF?

In the U.S., insurance coverage for IVF is a mixed bag. Most standard health plans—think private insurance through your job or marketplace plans—don’t automatically include fertility treatments. Why? Historically, insurers have viewed infertility as a “lifestyle choice” rather than a medical condition, even though about 1 in 8 couples struggle to conceive naturally. That mindset is slowly shifting, but we’re not there yet.

Here’s the reality: only about 25% of U.S. employers with 200 or more workers offer IVF coverage, according to a 2024 report from KFF, a nonprofit health research group. The numbers get better for bigger companies—over half of those with 5,000+ employees cover it—but that still leaves millions without help. If you’re on Medicaid or Medicare, coverage is even rarer, though some states are starting to change that.

So, what does get covered when insurance steps in? It varies, but here’s a quick rundown of what you might see:

- Diagnostic Tests: Bloodwork, ultrasounds, or semen analysis to figure out why conception isn’t happening.

- Medications: Fertility drugs to stimulate egg production (these can cost $3,000-$5,000 per cycle).

- IVF Cycles: The full process—egg retrieval, fertilization, and embryo transfer.

- Extras: Things like freezing embryos or genetic testing (less common).

Coverage isn’t all-or-nothing, though. Some plans cap the number of cycles (say, 2 or 3), while others only pay for diagnostics and leave the big-ticket items to you. That’s why digging into the fine print is key.

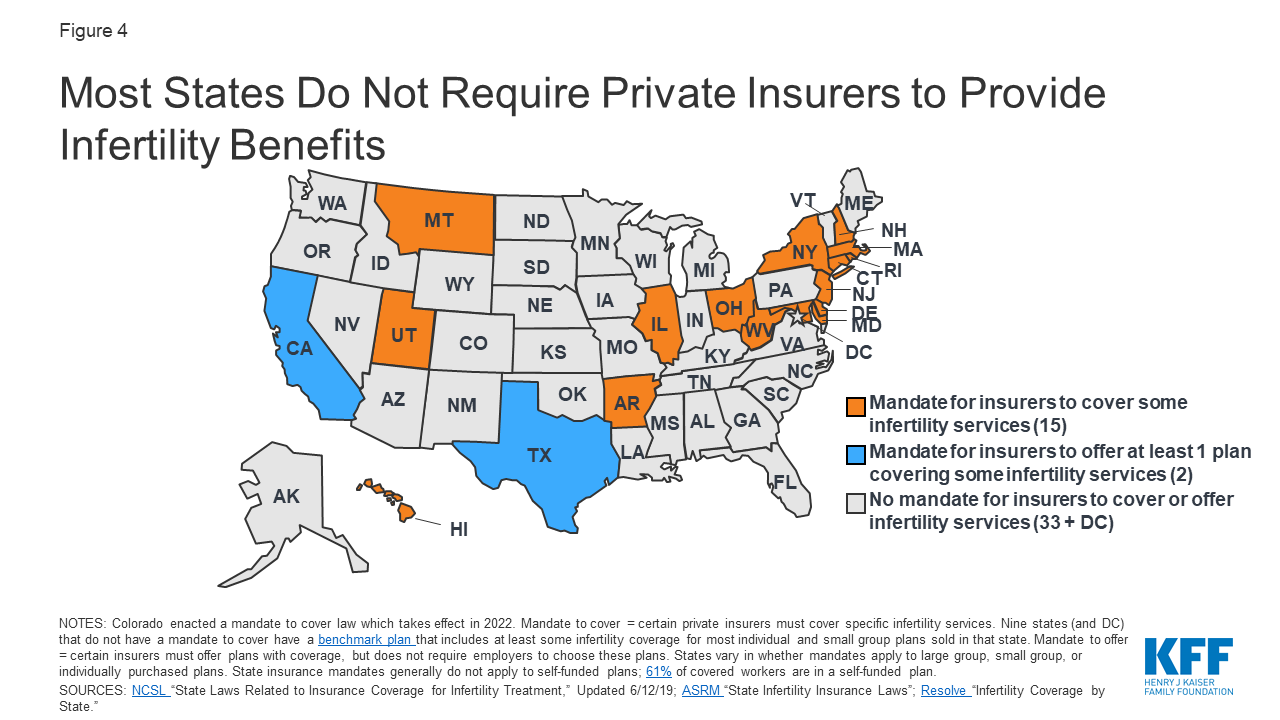

State Mandates: Where You Live Changes Everything

Your zip code can make or break your IVF coverage. As of April 2025, 21 states plus Washington, D.C., have laws requiring some level of infertility coverage for private insurance plans. These are called “state mandates,” and they’re a big deal if you’re in the right place. But not all mandates are created equal—some include IVF, while others stop short.

States That Cover IVF

Ten states have what experts call “comprehensive” IVF mandates, meaning they require insurance to cover IVF with minimal restrictions. These are:

- Connecticut

- Illinois

- Massachusetts

- Maryland

- New Jersey

- New York

- Rhode Island

- Delaware

- New Hampshire

- Ohio

In these states, if you have a fully insured plan (one regulated by the state, not your employer), you’re likely to get at least partial IVF coverage. For example, Massachusetts has one of the strongest laws—insurance must cover unlimited IVF cycles for eligible patients. A 2023 study from the American Society for Reproductive Medicine found that women in mandate states use IVF 3.2% more for every 1% drop in out-of-pocket costs. That’s a huge boost in access.

States With Partial Coverage

Other states, like California and Texas, have “offer” mandates. This means insurers have to offer a plan with infertility coverage, but employers don’t have to buy it. It’s a step up from nothing, but it’s not a guarantee. Then there are states like Arkansas and Hawaii, which cover infertility treatments but exclude IVF specifically.

The Catch: Self-Funded Plans

Here’s a twist: about 61% of workers with employer-sponsored insurance are on “self-funded” plans, where the employer pays claims directly. These plans are regulated by federal law, not state law, so mandates don’t apply. If your job offers a self-funded plan, IVF coverage depends entirely on your employer’s generosity—state laws can’t help you.

Employer-Sponsored Plans: The Wild Card

If you get insurance through work, your employer holds the reins. Big companies like Google, Apple, and Starbucks have made headlines for offering IVF benefits—sometimes covering up to $20,000 or more. Why? It’s a perk to attract talent in a competitive job market. A 2021 survey by Mercer found that 36% of employers with 500+ workers now include IVF, up from 27% in 2020.

But smaller companies? Not so much. If your workplace has fewer than 200 employees, your odds drop to about 1 in 4. And even with coverage, there are often limits—like a lifetime cap of $10,000 or a requirement to try cheaper treatments (like IUI) first.

Real-Life Example: Sarah’s Story

Take Sarah, a 34-year-old teacher in New York. Her school district offered a plan with IVF coverage, but it came with a $15,000 lifetime limit. One cycle cost her $18,000, including meds, so she still paid $3,000 out of pocket. After two failed rounds, she hit the cap and had to switch gears. “I wish I’d known the limit wasn’t per cycle,” she says. “It felt like a bait-and-switch.”

Sarah’s story shows why asking the right questions matters. Here’s a checklist to grill your HR department with:

✔️ Does our plan cover IVF?

✔️ Is there a lifetime or per-cycle dollar limit?

✔️ Are medications included, or separate?

✔️ Do I need to try other treatments first?

✔️ Are there age or diagnosis restrictions?

Medicaid and Medicare: Slim Pickings

If you’re on government insurance, IVF coverage is tough to come by. Medicaid, which covers low-income folks, varies by state. New York made waves in 2023 by expanding Medicaid to include fertility diagnostics and some treatments, but IVF itself isn’t covered yet. Most states don’t go that far—Medicaid usually stops at basic care.

Medicare, for people 65+ or with disabilities, doesn’t cover IVF either. It’s designed for older adults, so fertility isn’t a priority. However, if you’re a veteran with a service-related infertility issue, the VA expanded IVF benefits in 2024 to include up to three cycles for eligible couples— a rare win for public insurance.

Hidden Costs: What Insurance Might Miss

Even with coverage, IVF isn’t a free ride. Plans often leave gaps that catch people off guard. Here are three costs that don’t always make the cut:

1. Embryo Storage

Freezing extra embryos for later use is smart—success rates for frozen embryo transfers are climbing, hitting 45% for women under 35, per 2022 CDC data. But storage fees ($500-$1,000 per year) are rarely covered. Over five years, that’s $2,500+ out of pocket.

2. Genetic Testing

Preimplantation genetic testing (PGT) screens embryos for chromosomal issues, boosting success rates by 10-15%, according to a 2023 Fertility and Sterility study. It costs $3,000-$6,000 per cycle, and most plans skip it unless it’s deemed “medically necessary.”

3. Out-of-Network Surprises

Your fertility clinic might be in-network, but the lab or surgery center might not be. Brenna, a Florida mom-to-be, learned this the hard way in 2022. Her insurer covered IVF, but the out-of-network lab tacked on $500 per visit. “I felt blindsided,” she told NPR.

How to Find IVF Coverage: Your Action Plan

Ready to figure out your options? Here’s a step-by-step guide to track down insurance that covers IVF—without losing your mind.

Step 1: Check Your Current Plan

Call your insurance provider or log into your portal. Look for terms like “infertility services” or “assisted reproductive technology.” If it’s vague, ask a rep: “Does this include IVF, and what’s the limit?” Write down names and dates—you might need proof later.

Step 2: Talk to Your Employer

If you’re on a work plan, HR is your next stop. Ask if they offer IVF benefits or could add them. Some companies let you switch plans during open enrollment (usually fall), so mark your calendar.

Step 3: Explore State Marketplace Plans

If your job doesn’t deliver, check your state’s health insurance marketplace (via Healthcare.gov). In mandate states, you might find plans with IVF coverage. Compare premiums and out-of-pocket costs—cheaper isn’t always better.

Step 4: Consider a New Job (Yes, Really)

Sounds extreme, but companies like Amazon and Deloitte offer IVF perks. A 2024 X poll showed 62% of users would switch jobs for fertility benefits. If you’re job-hunting, filter for “family-building benefits” on sites like Glassdoor.

Step 5: Look Beyond Insurance

No coverage? Fertility loans (e.g., Future Family) or grants from groups like Baby Quest can help. Crowdfunding’s another option—plenty of families raise $5,000-$10,000 on GoFundMe.

Interactive Quiz: What’s Your IVF Coverage IQ?

Think you’ve got the basics down? Test yourself with this quick quiz—and see where you stand.

- True or False: All states require insurance to cover IVF.

- A) True

- B) False

- What’s the average cost of one IVF cycle without insurance?

- A) $5,000-$7,000

- B) $12,000-$20,000

- C) $25,000-$30,000

- Which of these might NOT be covered, even with IVF insurance?

- A) Medications

- B) Embryo storage

- C) Egg retrieval

Answers: 1) B—Only 21 states have mandates, and not all include IVF. 2) B—It’s a hefty range! 3) B—Storage often gets left out.

How’d you do? Share your score in the comments—I’d love to hear!

Three Under-the-Radar Factors Affecting IVF Coverage

Most articles skim the surface of IVF insurance, but there’s more to the story. Here are three angles you won’t find everywhere—each with fresh insights to help you plan.

1. Racial Disparities in Access

Insurance boosts IVF use, but not equally. A 2023 study in the American Journal of Obstetrics & Gynecology found that Black and Hispanic women in mandate states still use IVF 50% less than White women, even with coverage. Why? Higher out-of-pocket costs hit lower-income groups harder, and cultural barriers—like distrust in healthcare—play a role. Advocates are pushing for broader Medicaid expansions to close the gap.

2. The Rise of Fertility Tech

New tech is shaking up IVF costs—and coverage. Lab-on-a-chip systems, which automate parts of the process, could slash lab fees by 90%, per a 2022 paper in Reproductive Medicine. Insurers might cover these cheaper methods sooner than you think. Keep an eye on clinics offering “mild stimulation” IVF—it’s less invasive and could sneak under coverage caps.

3. Political Winds and Policy Shifts

IVF’s future hangs on politics. In 2024, Trump floated a plan to mandate IVF coverage, but it’s stalled amid debates over cost ($7 billion annually, says the Cato Institute) and embryo rights. Meanwhile, the “Right to IVF Act” failed in Congress—twice. If federal mandates pass, coverage could go nationwide by 2026. Stay tuned to X, where #IVFaccess trends spike during election cycles.

Comparing Coverage: A Handy Table

Still confused about what’s covered where? This table breaks it down based on real-world data from 2024-2025.

| Insurance Type | IVF Coverage Likelihood | Typical Limits | Out-of-Pocket Risk |

|---|---|---|---|

| State Mandate (Private) | High (in 10 states) | 1-3 cycles, $10K-$20K cap | Medium—gaps like storage |

| Employer (Self-Funded) | Medium (36% of big firms) | $10K-$25K lifetime | High—varies by company |

| Medicaid | Low (NY only, diagnostics) | None for IVF | Very High—all on you |

| Medicare/VA | Very Low (VA exception) | 3 cycles (VA only) | High—most uncovered |

Tip: Use this as a starting point when shopping for plans or negotiating with your boss.

What If Insurance Says No? Creative Workarounds

No coverage doesn’t mean no hope. Here are five ways to make IVF work, even on a budget:

- Negotiate Cash Discounts: Some clinics offer 10-20% off if you pay upfront. Ask!

- Join a Clinical Trial: Universities like UCSF sometimes cover IVF for research participants.

- Split Cycles: Do egg retrieval now, transfer later—spreads costs over time.

- Travel for Treatment: Clinics in mandate states might be cheaper than out-of-state options.

- Tap HSAs/FSAs: Use pre-tax dollars from health savings accounts—every bit helps.

Poll: What’s Your Biggest IVF Worry?

I’m curious—what keeps you up at night about IVF costs? Vote below and let’s get the conversation going:

- A) Finding affordable insurance

- B) Hidden fees sneaking up

- C) No coverage at all

- D) Something else—tell me in the comments!

Results will show up in next week’s update—stay tuned!

The Future of IVF Coverage: What’s Coming?

IVF insurance is evolving fast. A 2025 SIEPR study predicts that if subsidies kick in, first births among childless women aged 30-39 could jump by 3.5%. Automation might drop costs too—think $5,000 cycles instead of $15,000. And with 15% of couples facing infertility (CDC, 2023), pressure’s mounting for universal coverage.

But there’s a flip side. Some worry cheaper IVF could lead to overuse or ethical gray areas, like “designer babies.” Others say subsidies favor higher-income folks who’d pay anyway. The debate’s heating up on X, where #FertilityForAll posts argue both sides.

Wrapping Up: Your Path to IVF Coverage

Figuring out what insurance covers IVF isn’t a one-size-fits-all answer—it’s a journey. Where you live, work, and what you’re willing to fight for all shape your options. Start by checking your plan, lean on state laws if you’ve got them, and don’t shy away from creative solutions if coverage falls short. With a little digging and a lot of persistence, you can find a way to make IVF fit your life.

Got a story about your IVF insurance hunt? Drop it in the comments—I’d love to hear what’s worked (or hasn’t) for you. Let’s keep this conversation going and help each other out!